How can we help you?

Frequently Asked Questions

The U.S. government has amended rules to require financial institutions to collect and verify specific information from businesses establishing new memberships, shares or loans. Requiring the disclosure of key individuals who own and/or control a business helps law enforcement investigate and prosecute crimes. Have any questions? Email us. We're here to help! This requirement does not pertain to Sole Proprietorships or Business Club Associations.

U.S. government amended rules require all financial institutions to obtain and verify information about the beneficial owners of their business members. These rules are meant to help the government fight financial crime. Because businesses can be abused to disguise involvement in money laundering, terrorist financing, tax evasion, corruption, fraud, and other financial crimes, requiring the disclosure of key individuals who ultimately own and/or control a business helps law enforcement.

This is the person with significant responsibility for managing the business—for example, a chief executive officer, chief financial officer, chief operating officer, managing member, general partner, president, vice president or treasurer. Generally, this is the individual who has the authority to act on behalf of the business to make decisions.

For each person named on the certification, we are required to obtain their legal name, physical address, date of birth and Social Security number (SSN). If they are not a U.S. citizen, then a passport number may be provided in lieu of the SSN. Additionally, we will need a copy of a government-issued ID, like a driver’s license or passport, for verification of each named individual.

The beneficial ownership information is required when a new membership or share is opened, or when a new loan is obtained.

Once Westerra has obtained a beneficial ownership certification for your business, we may ask that you confirm the information when you open additional new accounts.

Indirect ownership means the business may be owned by one or more legal entities. Westerra is required to obtain information on the individual persons behind those layered entities who ultimately have the equivalent of 25 percent or more ownership of the business.

Yes. You would simply mark the box indicating there are no individuals with beneficial ownership and complete the section for the individual with significant management responsibility.

The individual authorized to open the membership or share, or apply for a loan, is the person to complete the certification. The person who provides information for the certification will sign it indicating the information is accurate to the best of his or her knowledge.

Westerra is required to maintain this information as part of our records associated with the business. We treat this information with the same high level of confidentiality and security as we do all our member information.

Westerra’s business mobile banking allows you to manage your business account from your mobile device. With Westerra’s business mobile banking, you can:

View account balances and history.

Transfer funds.

Pay bills.

Make mobile check deposits.

Monitor savings goals.

Find free ATMs and shared branches.

Receive email, text messages* or push notifications.

Business mobile banking provides three ways to access your accounts:

Download the mobile banking application to your phone (Apple App Store or Google Play for Android).

Receive SMS text alerts on your mobile phone.

Use the browser on your smartphone to access business online banking.

*Text Messaging and Data Rates May Apply. Check with your mobile phone carrier for details.

The business mobile banking app is available for iOS and Android smartphones and tablets.

Download the business mobile banking application to your phone or tablet: Apple App Store and Google Play for Android.

Westerra Credit Union is committed to protecting the safety and privacy of your business information. To ensure the security of your account information, a number of security features have been built into Westerra’s business mobile banking.

You must be enrolled in Westerra business online banking to use the app. If you are not enrolled in business online banking, go here to enroll.

On your mobile device, open the App Store (Apple) or Google Play (Android) and download the app.

Launch the app and enter your Westerra business online banking username and password.

There are no fees to use or access the business mobile banking app.

You should contact your mobile provider for information about fees associated with sending or receiving text messages or accessing the internet from your mobile phone.

All accounts that are accessible through Westerra’s business online banking are eligible for use with Westerra’s business mobile banking. You may choose which accounts to display by going into Settings > Accounts > and hiding or displaying accounts you want to see displayed.

Westerra Credit Union will never provide access to your full account numbers or other personal information via mobile banking. If your mobile phone is lost or stolen, no one can access your account without knowing your unique username and password.

If your mobile phone is either lost or stolen:

Report it immediately to your mobile carrier.

Then, immediately log in to Westerra business online banking from your computer and change your username and password.

Alternately, you can contact us at 303-321-4209 and request that the mobile number be removed from mobile banking access.

To log in to business online banking and bill pay:

Enter your username and password on any page of the website in the top right corner of the screen.

Click the login tab, then select the "Business" tab.

If you have forgotten your password, click on the "Forgot Your Password?" link and the system will guide you through the process of gaining a new password.

If this is your first time using business online banking and bill pay, click the "First time users enroll here" link.

Read and accept the business online banking disclosures and enter your business account number, your Tax Identification Number (TIN), email and zip code.

Next, create a username and choose an email address to receive your temporary password at.

Enter your temporary password and then create a new password.

Once you are logged in, you will be prompted to choose and answer three security questions and confirm or edit your contact information.

To use bill pay, log in to your business online banking account and click the bill pay widget.

Please make sure you are using one of the supported browsers to view business online banking:

Google Chrome: Latest two versions

Firefox: Latest two versions

Microsoft Edge: Latest two versions

Safari: Last two major versions

iOS: Last two major versions

Android: Last two major versions

When you sign up for eStatements, we stop mailing your paper statement.

To view your eStatements, click the eDocuments widget.

To enroll, log in to online business banking and select the "More" widget, then select the "eDocuments" widget, then click "Statements" tab. In most cases, eStatement enrollment is immediate. However, you may receive a paper statement if you enroll after a monthly statement has already been generated.

You can view your eStatements within all account types.

Click on the "Message Center" widget or on your name in the top right corner — click on "Messages"

Then click compose

Choose:

A subject

The account you’re messaging about, or you can also choose "No Specific Account"

Type your message

Attach a file if necessary

Click "Send Message"

Bills will be paid on the date on which you scheduled the payment to be made.

Your account will be debited on the day on which you scheduled the payment to be made.

eBills allow you to receive your bills electronically within business online banking. Your payees must offer this option in order to take advantage of this feature.

When adding a payee who is eligible for eBills you can select "Set up eBills" and verify your account with specific information. For example, you may be asked to provide your username and password for the provider, your account number, your billing ZIP code and/or the last four digits of your Social Security (SSN) or Tax Identification Number (TIN).

You will then be able to see your bill amount and due date from within the Bill Pay Dashboard. This makes paying your bills quick and easy.

Companies that provide bills through this service will allow you to view any eBills you are authorized to see, based on the information you provided during the sign-up process.

In some cases, these companies may elect to allow you to view bills where another individual's name, such as a spouse, is on the account, as long as you successfully provide the verification information required by the biller or payee.

Please make sure you are aware of the biller or payees’ policies.

If you have any questions while you are using Westerra’s bill pay service, call us at 303-321-4209 or 1-800-858-7212 or send us a secure message through business online banking.

Log into business online banking and select the bill pay widget. You can then add your payee information using the add payee button.

You can make a payment to anyone in the United States.

Once a payee is set up, use either the Bill Pay Dashboard or MultiPay tab to choose the payee, amount, and date the payment is for.

For scheduling multiple payments at once, use the MultiPay tab.

No, bill payment on business online banking only accepts payments from business checking accounts.

If your payment goes out as a paper check, it is sent to the address provided when setting up the payee.

If it goes out as an electronic payment, it is sent directly to the payee's account.

Only you can authorize payments. You tell us who, when, and how much to pay.

Payments are issued electronically or via paper checks, depending on the payee’s capability. Both electronic payments and paper checks always include remittance information, ensuring that your payee can accurately record that a payment has been received for your account.

Yes, bill payment through business online banking does not replace your checkbook. You can continue to write paper checks as you normally would if you so choose when using your Westerra Credit Union business account.

Paper checks are issued a few business days before the due date to ensure the payment is made on the due date. Please note processing times may vary.

Electronic payments are issued a few business days before the due date to ensure the payment is made on the due date. Processing times vary, but the payment will arrive on the due date.

Within the bill pay page, you can access the history tab. This shows you all the bill payments you have successfully made.

Funds are taken from the account on the due date when you use business online banking bill pay.

To cancel a payment, go to the Scheduled tab, and click delete next to the payment.

One time

You may select the start and end date of these occurrences:

Once every week

Once every two weeks

Once a month

Once per year

Every four weeks

Every other month

Quarterly

Every six months

Due to legal requirements, we limit the ability to make certain types of payments. Payments to payees outside of the United States are prohibited and may not be issued under any circumstances.

The following payments are discouraged, but may be scheduled at your own risk:

Tax payments to the Internal Revenue Service or any state or other government agency

Court-ordered payments, such as alimony or child support

Payments to insurance companies

Our bill payment provider will not notify you if you attempt to make any of these payments and will not be liable if the payment was not processed for such payments.

We issue standard approved payments against your checking account. Just as with a paper check, you have to maintain sufficient funds in the account to cover all payment obligations.

However, we are unable to notify you if you have insufficient funds. Please note that your business online banking bill pay account will be blocked until the payment is satisfied or funded.

eBills allow you to receive your bills electronically within business online banking. Your payees must offer this option in order to take advantage of this feature.

When adding a payee who is eligible for eBills you can select "Set up eBills" and verify your account with specific information. For example, you may be asked to provide your username and password for the provider, your account number, your billing ZIP code and/or the last four digits of your Social Security (SSN) or Tax Identification Number (TIN).

You will then be able to see your bill amount and due date from within the Bill Pay Dashboard. This makes paying your bills quick and easy.

Yes, you can pay your bills all at once using the MultiPay tab.

Some payees may continue to send a paper bill to your home even after you begin receiving the bill online.

To avoid making duplicate payments, it is best to pay only those bills that arrive online. Some payees may offer the option of turning off the paper bill, either by indicating such a preference on their website or you can contact their customer service department.

“Contactless” is a feature that allows a member to tap their card on any terminal with the “pay wave” icon (see below). This technology is quick, secure way for a transaction to process without the need to swipe or insert your Westerra debit or credit card (though, of course, you can still do both, if you prefer)

The identification technology called “near-field communication (NFC)” processes thetransaction, connecting with the computer chip in the Westerra card that has a specificfrequency antenna to communicate with the NFC-enabled terminal. The computer chip in the card then sends a one-time signal with a unique code for that specific transaction. Since these codes change each time the card is used, the chip and Tap2Pay transactions cannot be counterfeited. This is another added level of security Westerra is delighted to offer our members.

Courtesy Pay is a service that adds a measure of protection to your checking account. Courtesy Pay may cover your transactions when you do not have sufficient funds in your checking account for a fee as noted on our Fee Schedule. That means, instead of returning a check to the merchant because of insufficient funds, the credit union may pay your item which will save you additional charges from the merchant. Please view our additional FAQs for more information.

New Credit and Debit Cards Issued Starting in May:

Starting May 2024, all members who have a consumer and business Westerra debit and/or credit card will receive a newly designed card featuring this Contactless technology. Members will receive an email notifying them their new card is on its way. This email will include the last four digits of the current card number (card numbers will not change due to this re-issue). You can expect your cards to arrive separately with staggered delivery timeframes due to cards being issued based on its expiration date. Be sure to check out the activation information, next steps, and additional information included with your card mailer!

To activate a card, call 1-800-466-0040. Members will need to activate their new card within 45 days of receiving their card or the system will automatically block the new card. A member will receive email reminders throughout the 45 days before it is blocked. Once the contactless card is activated, the old card will be deactivated automatically by the system.

To report a lost or stolen Visa® credit, debit or ATM card, or for card inquiries:

Call 303-321-4209 or 1-800-858-7212 during business hours.

Visit one of our branch locations to have your credit or debit card issued instantly.

Contact us via secure messaging through Digital Banking.

Call 1-888-241-2510, 24 hours a day.

Please note: Cards sent by mail will arrive in approximately 4 to 7 business days. You will also receive a new PIN, which can be changed by calling 1-800-503-9249 and using the reference number on your PIN mailer.

Because you have better things to do than wait for mail, you can visit any of our branch locations to get an instantly issued card.

To get a new Personal Identification Number (PIN):

Call 303-321-4209 or 1-800-858-7212. We can order a new PIN to be delivered by mail.

If you would like to change your PIN, you can also stop by any of our branch locations during regular business hours, Monday through Saturday.

If you received a PIN mailer, you may also call 1-800-503-9249 to choose your new PIN over the phone, using the reference number on your PIN mailer.

Set up your Apple®, device to pay with your Westerra card on the go. Follow the steps on the Apple website here to set it up.For additional information: See here

Follow the steps via this link: GET TO KNOW GOOGLE PAY.For additional information: See here

Follow the steps via this link: HOW TO SET UP SAMSUNG PAY.For additional information: See here

Link you accounts to make automatic cash advances from your credit card, up to your credit limit on the credit card, for a 2% cash advance fee, to cover transactions when funds are not available in your checking/spending account. Complete this form to set credit card cash advances as overdraft protection.

Send us a message through Digital Banking or notify us at 303-321-4209 or 1-800-858-7212 Monday - Friday, 8 a.m.-6 p.m., or Saturday, 9 a.m.-1 p.m. with your travel dates and destination to head off any potential fraud alert service interruption on your credit or debit cards.

All new Westerra debit and credit cards will feature our new vertical design. Members will not be able to choose their designs or colors.

If this is your first time using Digital Banking:

Click "Login" on the top right corner of WesterraCU.com, then "Personal Banking."

Then, click on the "Enroll in Digital Banking" link.

Enter your account (member) number, the primary account holder's Social Security Number and date of birth and click "Continue."

Create your username and password.

Read and "Accept" the Digital Banking disclosures.

Then, click "Create."

Once you are logged in, you will be prompted to receive a one-time security code, verify your email address, and then you can access your accounts.

To log in to Digital Banking, click "Login" on the top right corner of this website, then "Personal Banking," and enter your username and password on the next screen.

If you have forgotten your username or password, click on the "Forgot Username?" or "Forgot Password?" link and it will guide you through the process of entering a new username or password.

While you can reach our Digital Banking from any browser, Westerra recommends accessing our platform via Google Chrome, Firefox, Edge or Safari.

As always, we encourage members to always keep their browsers updated, so that you're using the most recent version of these browsers for security purposes.

Digital Banking may appear differently and some functions may not be available depending on your browser and how you access the platform.

To enable text* notifications:

Log in to your Digital Banking account on your browser.

Go to "Self-Service."

Then, "Manage Notifications."

Click on the account that you want to enable the notifications for.

Click the toggle button on the right to enable the type of notification you want.

Then, check the box for "SMS" to receive text message notifications.

If you have questions about the capabilities of your mobile phone, please contact your mobile carrier for more information.

*Standard messaging charges may apply:Every mobile carrier has a different rate plan for text messaging and data services access. You may be charged per use, or pay a flat rate for unlimited usage each month. You may also have different fees for text messaging and data services access.

Contact your mobile carrier directly if you aren’t sure what fees you will be charged to use mobile banking, as Westerra Credit Union has no access to information regarding your personal mobile service billing.

You will find 36 months of statement history in the eStatements section.

If you're logged in on a web browser:

Go to "Self-Service."

Then, click on "Account Statements."

Select the account you want to view the eStatement

Choose either preview or download the eStatement you want to view per month.

Please know that you have been automatically enrolled in eStatements, which means you will no longer receive paper statements in the mail. Instead, you will receive an email notification when your electronic statement is ready each month.

If you wish to opt-out from receiving eStatements and wish to receive paper statements via mail instead, please contact us at 303-321-4209 or 1-800-858-7212, Monday - Friday, 8 a.m.-6 p.m., or Saturdays, 9 a.m.-1 p.m., or email us at: Email@WesterraCU.com.

If you're logged in on a web browser, you can send a secure message by selecting the three dots next to the "Self-Service" button at the top of the page, and then select "Messages" from the dropdown menu.

To view the taxes and interest or the year end tax information for your Westerra Credit Union mortgage loan on your desktop web browser:

Log in to Digital Banking.

Select “My Accounts.”

In "My Accounts," scroll down to where your mortgage loan is listed.

Select your mortgage loan with Westerra Credit Union.

Click on the “Details” tab for your mortgage loan.

Then, select “More Details” to open the Mortgage Portal that will open in a new browser tab.

In the Mortgage Portal, select “Loan Information” from the top menu on the left. Here, you can further select from two viewing options for your tax documents:

Click on "Taxes and Interest" if you wish to view last year's taxes and interest, or your current taxes and interest information.

Or select "Year End Information" to view and download your year end tax information. Your Westerra Credit Union year end tax information will be mailed to you by January 31 the following year, and will be available in the mortgage portal by the end of January. This online year end tax and interest information can be used for completing your tax returns.

Tax Tip: Locate your 13-digit account number inside digital banking, on the My Accounts page (below the account name).

Please call us at 303-321-4209 for assistance with disabling your Digital Banking account.

Paying your bills online is quicker, easier and safer than writing checks. Receive your bills, or eBills, electronically and add new payees at any time. You can pay your bills when you’re away from home, at work or even on vacation.

You can send a one-time payment or set up a schedule for recurring payments, and you can easily change payments requiring different amounts each time.

Log in to Digital Banking to pay your bills.

The earliest an electronic bill payment can be delivered is the next business day.

For mailed check payments, standard delivery time is five (5) business days from the current day. Expedited delivery time is two (2) business days from the current day.

For electronic payments, the money leaves your account on the "Send" date.

In some cases, a mailed paper check must be issued to the biller. For these payments, the money leaves your account when the check is cashed or deposited.

In your list of payees, electronic payees will have a lightning bolt next to their names; check payees will have an envelope next to their names.

2:00 p.m. Mountain Time.

You can schedule recurring payments with no end date. You can even schedule annual payments. If you should happen to schedule a payment to be received on a weekend or a holiday, it will automatically adjust to the following business day.

An eBill, or electronic bill, is like the paper statement you receive each month now in an electronic format for viewing online. You can see all of the same detail in an eBill that you can in a paper statement.

We’ve updated our Digital Banking system

As a result, the option to set up an external transfer to make your mortgage payment has been retired. This update offers other convenient and easy ways to pay.

Please select one of the options below to make your upcoming mortgage payment:

Make a one-time or automatic payment to your mortgage loan through Digital Banking.

Log into Digital Banking

Click on your mortgage account

Select "Details"

Then, "More Details"

Next, select "Online Payment" in the top navigation

Finally, select either "Make Payment" or "Automatic Payments"

Set up automatic payment transfers by registering at YourMortgageOnline.com/register.

Make a payment directly from your external financial institution through their Bill Pay feature. Have your mortgage account number available and use the following information as needed: Westerra Credit Union, 1 Corporate Drive, Suite 360 Lake Zurich, IL 60047-8945

Pay by phone by calling 303-321-4209 and select option 0 to speak with member services. Paying by phone has a fee: $10 for check payments, $20 for card payments.

Visit any of our convenient branch locations or over 30,000 CO-OP Shared Branch locations nationwide.

Need assistance? Contact us at 303-321-4209 or email us at Email@WesterraCU.com.

Expedited payments allow you to have bill payments delivered two (2) business days from the current day.

Expedited payments are only available for paper check payments and will be sent via two-day delivery for a fee, which will display before you go to submit the payment.

Each payment and fee is listed on your payment activity.

No, processing of your payment begins immediately after you submit your payment.

External Transfers are an option in Digital Banking that enables you to:

Transfer money between (to or from) your Westerra account and your account at another financial institution.

Set up automated recurring transfers to save time.

The money is debited/withdrawn from your Westerra account on the "Send" date.

The money is credited to/received at your external account within three (3) business days of the "Send" date.

To send from a checking account, the cutoff time is 2:00 p.m. Mountain Time, the same cutoff time as for Bill Pay and Pay People (P2P).

Electronic funds are never delivered on a weekend or holiday. USPS may deliver paper checks on a weekend if the business in question receives weekend mail. Otherwise, such checks will be delivered the following business day.

Not yet — but watch for more information coming soon!

You can transfer money to and from any Westerra spending, checking, savings or money market account. You can also transfer (make a payment) to Westerra auto loans, home equity loan, line of credit or personal loan.

Yes – it is critical that the primary member’s first and last name, date of birth, and Social Security Number match on both accounts. If they do not match, use Pay People (P2P) transfers instead.

You may add up to a total of two phone numbers, but the code will be sent only to the phone number you choose.

After logging in to Digital Banking, click on Self-Service, then My Profile, and then the phone number section.

Please call us at 303-321-4209 for further assistance.

You may be locked out of Digital Banking if you tried to enter your password unsuccessfully multiple times. Please call us at 303-321-4209 or 1-800-858-7212 (Monday - Friday, 8 a.m.-6 p.m., Saturday, 9 a.m.-1 p.m.) for assistance with unlocking your account.

For security purposes, the system will not let you use a password you have used in the past. Please create a new password.

With the Westerra Rewards program, you can earn reward points for cash back, gift cards, travel, experiences, merchandise and more with your Visa Signature® credit or debit card. Plus, you can earn bonus points! Westerra Rewards is our way of thanking you for choosing Westerra.

Visa Signature® credit card purchases – Earn 1.25 points for every $1.00 you spend.

Debit card purchases – Earn 1 point for every $3.00 you spend when you sign for your purchase.

Business rewards credit card purchases – Earn 2 points for every $1.00 you spend.

Bonus points – Earn bonus points when you use the ShoppingFLING feature on Westerra Rewards.

If you already have a Westerra debit card or Visa Signature® credit card, you are already part of the rewards program. Reward points will automatically be combined in your rewards account for your Westerra cards based on your primary account information. Personal and business reward points will not be combined.

Access and redeem your rewards points through Westerra Digital Banking:

For personal accounts: Log in to Digital Banking on your browser, look for "Card Rewards" in the "Quick Actions" menu on the right.

For business accounts, login to business online banking and select on "Rewards." This will take you directly into Westerra Rewards without needing to register or sign in a second time.

If you prefer, you can access your rewards account online at Westerra Rewards and register using your name exactly as it appears on your Westerra account and the last six digits of either your Westerra Signature or business rewards credit or debit card.

If you do not have a Westerra Visa Signature personal credit or debit card, reward yourself - you've earned it. Apply Now!

Points can be redeemed at any time through Westerra Rewards.

Cash Back – You have the option to redeem rewards points for cash to be applied directly to your account.

Gift Cards – Redeem for gift cards to your favorite places to shop and dine. There are even electronic gift cards you can use instantly online or at the store.

Travel – Westerra Rewards offers the largest selection of travel rewards in the market today. Choose from flights, cars, hotels, cruises, vacations and experiences.

Experiences – Redeem your points for experiences, theme parks and events, concerts, sports and event tickets.

Merchandise – Redeem points for home appliances, sports items, computers, electronics, gourmet foods and more.

Charitable Donations – You also have the option to donate your points.

Intuit is a company that produces tools to assist individuals and businesses in managing their finances. Examples of common tools include: Quicken, QuickBooks, TurboTax, and Credit Karma.

As of May 21, 2024, members will be able to add their Westerra transactions to Intuit products. The Intuit connection types that will be available are Web Connect and Express Web Connect.

Business banking members are already able to integrate Digital Banking with Quicken and QuickBooks.

Users can add their transactions manually by signing in to their Westerra Digital Banking account and downloading (exporting) transactions into a .QFX (Quicken) or .QBO (QuickBooks) file, then importing that file into their Quicken or QuickBooks software.

Users can automatically import Westerra transactions to Quicken or QuickBooks after linking their Digital Banking account by entering their log-in credentials. A prompt should display within Quicken or QuickBooks with instructions on how to link your Digital Banking account.

Checking accounts, savings accounts, and credit cards will be supported by this integration.

Existing users are encouraged to review the following Conversion Guides for more information: Quicken Conversion General Instructions, QuickBooks Online Conversion Instructions and QuickBooks Desktop Conversion Instructions

For general questions about Quicken or QuickBooks or technical support, contact Intuit Product Support.

Westerra mobile banking allows you to manage your account from your mobile device. You can:

View account balances and statements.

Transfer funds between accounts.

Pay bills you have set up.

Send secure messages.

Manage and receive mobile alerts via text messages* and push notifications.

Deposit checks from your smartphone using mobile check deposit.

Pay people directly from your smartphone using Pay People.

Two ways to access your accounts:

Download the mobile banking application to your phone (Apple App Store or Google Play for Android).

Use the browser on your smartphone to access Digital Banking.

*Standard messaging charges may apply:Every mobile carrier has a different rate plan for text messaging and data services access. You may be charged per use or pay a flat rate for unlimited usage each month. You may also have different fees for text messaging and data services access.

Contact your mobile carrier directly if you aren’t sure what fees you will be charged to use mobile banking, as Westerra Credit Union has no access to information regarding your personal mobile service billing.

The mobile banking app is available for iOS and Android smartphones.

Download the mobile banking application to your phone: Apple App Store and Google Play for Android.

Westerra Credit Union is committed to protecting the safety and privacy of your information. To ensure the security of your account information, a number of security features have been built into the Westerra mobile banking app.

On your mobile device, open the App Store (Apple) or Google Play (Android) and download the app.

Launch the app and enter your Westerra Digital Banking username and password.

To enable text* notifications on the mobile app:

Log in to your account.

Click on the three dots that also say "More" under it.

Then, "Manage Notifications."

Click on the account that you want to enable the notifications for.

Select the type of notification you want.

Then, click the toggle button to allow notifications.

Finally, choose which "Channel" – either "Push," "SMS" or "Email" – you want by clicking the toggle button.

If you have questions about the capabilities of your mobile phone, please contact your mobile carrier for more information.

*Standard messaging charges may apply:Every mobile carrier has a different rate plan for text messaging and data services access. You may be charged per use, or pay a flat rate for unlimited usage each month. You may also have different fees for text messaging and data services access.

Contact your mobile carrier directly if you aren’t sure what fees you will be charged to use mobile banking, as Westerra Credit Union has no access to information regarding your personal mobile service billing.

Westerra Credit Union will never provide access to your personal information via mobile banking. If your mobile phone is lost or stolen, no one can access your account without knowing your unique username and password.

If your mobile phone is either lost or stolen:

Report it immediately to your mobile carrier.

Then, immediately log in to Westerra Digital Banking from your computer and change your password.

No

Must be a signature, Point of Sale (POS), or bill pay transactions on a consumer VISA® debit card and/or credit card. ATM and cash advance transactions do not count toward the transaction requirement. Transactions must be posted within the statement cycle. Authorizations or holds will not be included in the count. Qualifying card swipes will be counted on the last day of the month prior to dividend posting taking place. Card swipes on all consumer VISA debit and credit cards that live on the same account as the Money Market Select will be included in the total monthly transaction count.

For both our Money Market and Money Market Select product, you will need a Prime Share. However, for our Money Market Select, you will need a Westerra consumer VISA® debit and/or credit card on the same account that completes a total of 10 or more combined qualifying posted card transactions each month during a qualifying statement cycle to earn 3.50% APY. Those products are not required to open a Money Market Select.

Yes. You can order checks for use exclusively with the Money Market or Money Market Select products.

You can move funds into a Money Market share from other Westerra accounts, cash, check, or direct deposit/ACH.

Funds can be accessed through digital banking transfer to other Westerra accounts, writing a check drawn from the Money Market share, or by visiting a branch to withdraw funds as cash or check.

No. Regulation D (REG D) is currently suspended until further notice.

No. You will receive a regular monthly account statement.

Non-sufficient funds (NSF), or insufficient funds, is the status of a checking account that does not have enough money to cover all transactions. NSF also describes the fee charged when a check is presented but cannot be covered by the balance in the account. Please view our additional FAQs for more information.

Overdraft Protection is an optional level of protection you can elect to add to any checking account to help manage your finances and avoid over-drafting your account. Overdraft Protection can save you from incurring fees when you don’t have sufficient funds in your checking account. It is also useful for covering unexpected costs in an emergency. Please view our additional FAQs for more information.

Similar to Zelle, Pay People is a free person-to-person (P2P) payment service in Digital Banking and our mobile app that makes sending and receiving money as easy as emailing and texting.

In notifications, you may also see it referred to as PayItNow.

When funds are going from debit card to debit card, the transfer occurs right when the recipient accepts the transfer — even on weekends and holidays!

If the transfer is from a spending or checking account, once the recipient has accepted the transfer, funds are withdrawn from your account that evening, and delivered to the recipient within three (3) business days. These transfers do not take place on weekends or holidays.

To send from a checking account, the cutoff time is 2:00 p.m. Mountain Time, the same cutoff time as for Bill Pay and Pay People (P2P).

A PIN Mailer is no longer required to activate your Westerra debit or credit card! NOTE: the new phone number to activate a card is 1-866-762-0558 (this has been updated on the sticker of the card). Members will be required to enter in the card information, the last 4-digits of the primary account holder’s social security number and their date of birth.

Business members will be required to enter in the last 4-digits of their SSN or their EIN number; this is based on what is reflected on their account. Once the card is activated, they will be prompted to select their PIN. If a member already has an active card and calls 1-866-762-0558, the message will say that the card is already activate and ask if you would like to update your PIN.

What is Westerra Credit Union's Routing Number?

Routing Number: 302075319

When a check is issued, it requires an endorsement before you can deposit it.

It is important that you properly endorse your check to avoid possible returns or delays in processing it, and getting those funds deposited into your account.

The following tips will guide you in making sure your check is properly endorsed, depending on the type of check, the issuer, and who it is made payable to.

Be sure each payee endorses the back of the check and it is deposited into an account held jointly.

Checks payable to multiple payees cannot be deposited into a single owner’s account.

What is government check?

A government check is a U.S. Federal, State or Local Government Payroll, Expense Reimbursement, Tax Refund, or Benefit Assistance check. Some examples include:

TABOR

Government Stimulus

Social Security

Disability

Child Support

What about insurance checks that have two or more payees listed?

When an insurance check has “and” between the payee names, both signatures are required for this type of check to be properly endorsed, and this check must be deposited into a joint account.

If the insurance check has “or” between the payee names, either payee signature is accepted and can be deposited into either payee’s account.

If the insurance check has an "or" but it is not between the payee names, both signatures are required and must be deposited into a joint account.

A government check that says "Endorsement for Benefit of" or for benefit assistance for "Social Security," "Disability," or "Child Support" must be deposited into an account in the name of the beneficiary.

For example, if the check says, "John Doe for benefit of Jane Doe" it needs to be deposited into Jane Doe's account.

A check that says "Restrictive Endorsement" means that there are limits to what can be done with that check. For example, it might say: "John Doe for mobile deposit only".

"For mobile deposit only" should be written below endorsement(s) on checks deposited through mobile check deposit.

Please note that restrictive endorsements alone are not permitted on government issued or insurance checks. This means that the payee cannot simply write “for deposit only” on the back of the check and not endorse it. These checks must be endorsed by all payees. Once endorsed by all payees, then you can notate “for deposit only.”

An endorsement that includes "without recourse" cannot be accepted.

A blank check endorsement is when the back of a check is signed by the account owner, but a specific payee is not identified. The most common example of blank endorsements are checks payable to “cash” or the account owner’s name and presenting the check at their financial institution for cash or deposit.

A check with a special endorsement means that the payee has signed the check over to another party. These checks are also commonly known as “third party checks.”

"Third party checks" are approved on an exception basis only and must be reviewed prior to presenting the check for cash or deposit. Please visit your local branch or contact us for more information.

Signed over – Third Party checks

"Jane Doe pay to the order of John Doe"

Please note that third party checks cannot be deposited through Mobile Check Deposit.

WeGotYa is a Courtesy Pay service that adds a measure of protection to your spending/checking account.

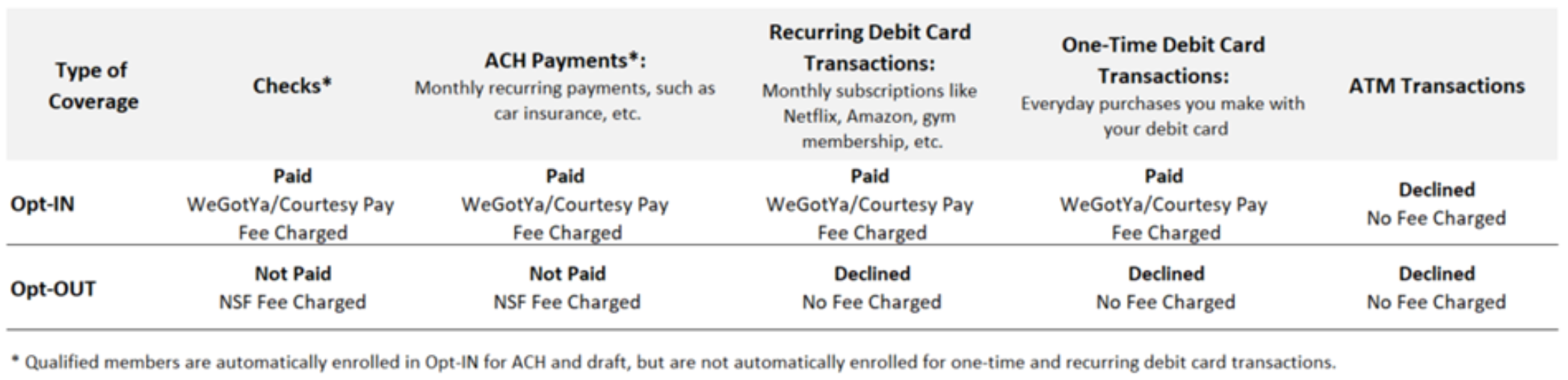

WeGotYa (Courtesy Pay) may cover your transactions when you do not have sufficient funds in your spending/checking account. You will be charged a $20 WeGotYa (Courtesy Pay) fee each time we pay a transaction that overdraws your account. A maximum of three fees per day, per checking. You will only incur WeGotYa (Courtesy Pay) fees for covered transactions if your account is overdrawn. That means, instead of declining an automated (ACH) payment, check, one-time or recurring debit card transaction because of insufficient funds, Westerra Credit Union may pay your item, which may save you additional charges from the company you intended to pay.

If you’re set up for automated (ACH) payments or checks, good news: You’re automatically enrolled in WeGotYa (Courtesy Pay). If you’re not, members must Opt-IN to WeGotYa (Courtesy Pay) for one-time and recurring debit card transactions.

To qualify for WeGotYa (Courtesy Pay), you must be at least 18 years old, have your spending/checking account opened for more than 30 days, and be in good standing with the credit union. These criteria may be changed at any time without notice. WeGotYa (Courtesy Pay) does not cover transactions through ATMs, tellers, phone banking, Digital Banking transfers or Money Market Account checks.

All members are automatically enrolled in WeGotYa (Courtesy Pay) for automated (ACH) payments or checks. Members must Opt-IN to WeGotYa (Courtesy Pay) for one-time and recurring debit card transactions.You have options to choose from:

We’ve made Opting-IN or Opting-OUT easy and can be done at any time during your account ownership. Simply complete any of the methods below:

Send a secure message through our Digital Banking message center.

Contact a member service representative by calling 303-321-4209.

Visit a member service representative at any of our convenient branch locations.

If there are not sufficient funds in your spending/checking account when a transaction is presented for payment, it may be paid using funds in this order:

Through transfers from your Westerra savings or Money Market Account (if applicable).

Through the available balance in your overdraft line of credit or Westerra credit card line or credit (if applicable).

Through WeGotYa (Courtesy Pay) — up to $200 on your Everyday Money account, or up to $750 for free or interest-earning spending/checking accounts, for a fee.

You then need to bring your account current within 30 days.

After the above options are accessed, if available, and there are still insufficient funds in the available account balance at the time of the transaction, the transaction will be declined, without a fee. However, you might have to pay fees from the company you intended to pay.

Your checking account has two kinds of balances: the actual balance and the available balance. Both can be checked by reviewing your account online, at an ATM, by phone or at a branch. It is important to understand how the two balances work so that you know how much money is in your account at any given time.

Your actual balance is the amount of money that is actually in your account at any given time. It reflects transactions that have posted to your account, but not transactions that have been authorized and are pending. While the term “actual” may sound as though the number you see is an up-to-date display of what is in your account that you can spend, that is not always the case. Any purchases, holds, fees, other charges or deposits made on your account that have not yet posted will not appear in your actual balance.

For example: If you have an actual balance of $50, but you just wrote a check for $40, then your actual balance will still show as $50, but it does not reflect the incoming or pending check transaction, so at this point, your actual balance will still say $50, but you have already spent $40.

Your available balance is the amount of money in your account that is available to you to use without causing a payment or transaction to be declined. The available balance takes into account things like holds placed on deposits and pending transactions — such as pending debit card purchases — that Westerra has authorized, but that have not yet posted to your account.

For example: You have an actual balance of $50 and an available balance of $50. If you were to use your debit card at a restaurant to buy lunch for $20, then that merchant could ask us to pre-authorize the payment. In that case, we will put a hold on your account for $20. Your actual balance would still be $50 because this transaction has not yet posted, but your available balance would be $30 because you have committed to pay the restaurant $20. When the restaurant submits its bill for payment, which could be a few days later, we will post the transaction to your account and your actual balance will be reduced by $20.

Your available balance is used to determine when your account will be overdrawn. For example: Your actual and available balances are both $50, and you use your debit card at a restaurant for $20. A hold is placed on your account, so your available balance is only $30. Your actual balance is still $50. Before the restaurant charge is sent to Westerra for processing, a check that you wrote for $40 clears. Because you have only $30 available (and you have committed to pay the restaurant $20), your account will be overdrawn by $10, even though your actual balance is $50. In this case, we may pay the $40 check through WeGotYa/Courtesy Pay, for a fee, and your account is overdrawn by $10. At our discretion, Westerra may decline or return a transaction unpaid for a fee.

It is very important to understand that you may still overdraw your account even though the available balance appears to show there are sufficient funds to cover a transaction that you want to make. This is because your available balance may not reflect all your outstanding checks and automatic bill payments that you have authorized, or other outstanding transactions that have not been paid or posted from your account. In the example above, the outstanding check will not be reflected in your available balance until it is presented to us and paid from your account.

Also, your available balance may not reflect all of your debit card transactions. For example, if a merchant obtains our prior authorization but does not submit a one-time debit card transaction for payment within two calendar days of authorization, we must release the authorization hold on the transaction. The available balance will not reflect this transaction once the hold has been released until the transaction has been received by us and paid or posted from your account.

Transactions are paid in the chronological order they are received, regardless of the dollar amount or method of presentation for payment on the account.

When more than one check is received on the same day, they are processed in check number order.

When automated (ACH) transactions are received on the same day, deposits to your account are posted first, followed by payments. If the balance in your account is exceeded, all subsequent items will be declined to the merchant or returned unpaid without a fee.

You will be charged a $20 WeGotYa (Courtesy Pay) fee each time we pay a transaction that overdraws your account. A maximum of three fees per day, per checking. You will only incur WeGotYa (Courtesy Pay) fees for covered transactions if your account is overdrawn. That means, instead of declining an automated (ACH) payment, check, one-time or recurring debit card transaction because of insufficient funds, Westerra Credit Union may pay your item, which may save you additional charges from the company you intended to pay.

Both overdraft protection and WeGotYa (Courtesy Pay) are designed to prevent you from having a transaction rejected due to nonsufficient funds (NSF), saving you any additional fees from a merchant or biller.

Overdraft protection does this by allowing funds to be transferred from a previously designated account (including any savings account or overdraft line of credit you have at Westerra) to pay for an item. Overdraft protection will NOT allow the account to be overdrawn (or go into a negative balance) to pay an item.

WeGotYa (Courtesy Pay) is a noncontractual courtesy payment program offered at the sole discretion of Westerra Credit Union that works this way: Instead of returning the transaction to the merchant and if your account is in good standing, we may approve your overdrafts within your current available WeGotYa (Courtesy Pay) limit for a fee. You will then need to bring your account to a positive balance (or good standing) within 30 days.

Set alerts in Digital Banking to let you know if your account reaches a certain high or low balance or if transactions over a certain amount take place on your account. Digital Banking is free for all members.

Download the free CardNav App to receive real-time notifications on your phone every time a transaction is made on your account. You can set spending limits, approved merchant locations and types of transactions — and you can turn your cards on or off instantly.

Use the free Westerra mobile banking app to quickly and easily check your balances.

Record all your automated transactions, bill payments, Digital Banking transfers, checks, debit card transactions, ATM withdrawals and other payments. Be sure you are tracking your actual balance, not just your available balance.

Ask us to automatically transfer funds from your other accounts when there are not enough funds in your spending/checking account to cover transactions. Choose the order you prefer to have funds transferred from – call us at 303-321-4209 or inquire at any branch to set it up:

Share account – Transfers are made in increments of $25 up to your available balance.

Money Market Account (if applicable) – Transfers are made in increments of $25 up to your available balance.

Overdraft line of credit (if applicable) – The amount needed to cover the transaction is transferred. Any fees and minimum payment are based upon the amount advanced. Apply at any branch or call us at 303-321-4209.

Westerra credit card – For debit card transactions, the amount needed to cover the transaction is transferred, up to your credit limit on the credit card, for a 2% cash advance fee. For all other methods of payment, transfers are made in the nearest increment of $25, up to your credit limit on the credit card, for a 2% cash advance fee. Complete this form to set credit card cash advances as overdraft protection. Apply for a Westerra credit card online, at any branch or call us at 303-321-4209.

When funds are depleted from the accounts you designated, Westerra may pay your transaction at our discretion through WeGotYa/Courtesy Pay.

After the above options are accessed, if available, and there are still insufficient funds in the available account balance at the time of the transaction, the transaction will be declined, without a fee. However, you might have to pay fees from the company you intended to pay.

Wire transfers are a way to electronically transfer funds from one person or entity to another person or entity.

Quick tips:

Do not wire funds to anyone who overpays for something sold online or sends a check or money order, then cancels the deal and asks you to cash the check and wire back the money.

Give checks or money orders you receive from a stranger time to clear your accounts before you use the funds. Check with your financial institution for guidelines. If something feels off, it probably is.

Domestic and international wire transfers are typically sent the same business day if they are submitted prior to 2:00 p.m. MT. Otherwise, your wire will be sent the following business day.

Request an outgoing domestic wire transfer here or visit one of our branch locations. There is a $20 fee for domestic wires.

Request an outgoing international wire transfer here or visit one of our branch locations. There is a $50 fee for international wires. Please note that you will need to provide a correspondent bank that is compatible with the receiving financial institution. Please contact the receiving financial institution for guidance and information about the specific institutions they work with, as Westerra Credit Union does not have this information.

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) Code is a unique identification code that may be required by some banks, broker-dealers and investment managers for the completion of international wire transfers.

Grandparent Scam: When you receive an unexpected phone call where the con artist poses as a relative in distress or someone claims to represent their relative and requests that your funds be transferred to them immediately.

Lottery/Sweepstakes Scam: When the victim receives a call or a letter stating that they have won a prize and in order to claim the prize, they must first pay taxes. You have not really won the sweepstakes if you are asked to pay to collect your winnings. Foreign lotteries are illegal — you have not won.

Craigslist Scam: When the victim sells an item online and is paid with a check for a larger amount, the scammer will request that the remaining funds be wired back to them.

Sweetheart Scam: When the scammer sends the victim a large check and requests some of the funds be wired back to them. These scammers usually gain your trust or could make you believe that you are in a relationship with them.

Email Wire Fraud: When a criminal hacks into someone else’s email account, impersonates them, then proceeds to reach out to their contacts and requests funds be wired to the hacker's accounts.

Rental Scam: When scammers post property rental ads to lure unsuspecting renters and request a deposit and upfront rent payments via wire transfer.

Title Company Scam: When the victim receives communication from someone claiming to be from a title or escrow company with instructions on where to wire funds.