Managing finances as a family

Build a budget that supports what matters most

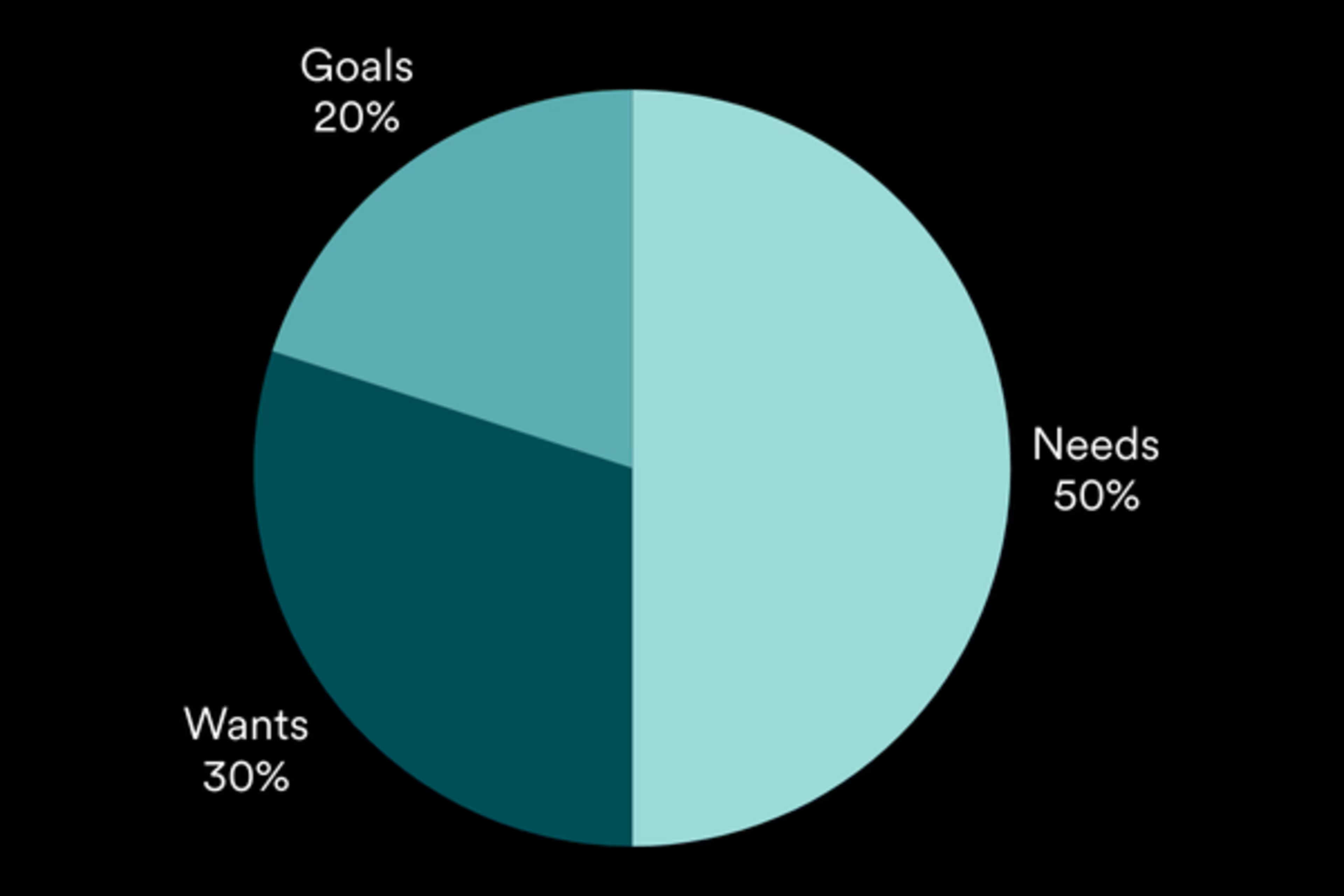

When your budget feels tight, it’s easy to feel overwhelmed. We want to give our kids everything. But even setting aside a small amount can help you feel more in control. Track your spending; group it into needs, wants and goals, and try; the 50/30/20 rule to guide your plan. That pie chart isn’t just numbers — it’s your reminder that you’ve got this.

Set one small goal — like saving $50 a month or reducing takeout — and build from there.

Review and adjust monthly. Life changes, and your budget should too.

You can be ready for what life throws your way

Emergencies happen — a medical bill, car repair or change in income can shake your budget. Start with a goal to save $500 in a separate account. Automate small transfers and use tax refunds or bonuses to build it faster.

Check with your employer’s benefits provider. You might have access to emergency savings tools or financial wellness programs that can help create a stronger safety net.

You don’t have to be ready for everything. Just ready for something.

Lending decisions that strengthen your family’s future

Taking out a loan should begin with clarity — not just about the numbers, but about the purpose. What are you working toward together? A reliable vehicle, a more livable space or a way to simplify monthly expenses?

Encourage open dialogue around:

Shared financial goals

Individual concerns or hesitations

How the loan fits into your broader financial picture

At Westerra, we believe financial decisions should empower—not pressure—your family.

A loan can be a smart financial tool when it’s used to support progress, not create pressure. Ask yourselves:

Does this loan help us move forward in a meaningful way?

Can we manage the payments without sacrificing other priorities?

Have we compared options to find the best fit for our needs?

If the answer is yes, a loan might be the right step. And if you're still weighing the pros and cons, Westerra is here to help you explore your options so you can borrow with confidence and stay focused on what matters most.

Finances and your family FAQs

Begin by understanding your current financial picture. Track all sources of income and every expense for a month. This helps you see patterns and identify areas to adjust. Then, set goals together as a family. Whether you're saving for a vacation, paying off debt or building an emergency fund, your budget should reflect your needs. Keep it simple and consistent. Budgeting is a skill that improves with practice.

Start with a conversation about your financial goals. Create a shared budget for essentials and savings, and allow space for individual spending. This helps reduce tension and builds trust. Financial compatibility is something you build together through communication and compromise.

Use your lowest expected monthly income as your baseline. Prioritize fixed expenses like housing and utilities, and build flexibility into the rest. During higher-income months, allocate extra funds toward savings or debt. Consider creating separate savings buckets for predictable but irregular costs like holidays, school supplies or car maintenance.

A good starting point is $1000. From there, aim for three to six months of essential expenses. This fund acts as a financial safety net, helping your family stay afloat during unexpected events like job loss, medical emergencies or major repairs. Start small and build consistently. Every dollar counts.

Yes. A small emergency fund helps you avoid relying on credit cards or loans when life throws you a curveball. Once you have that cushion, shift focus to high-interest debt. This approach creates stability while working toward long-term financial health.

Emergency expenses are unexpected, necessary and urgent. Examples include medical bills, car breakdowns, job loss and home repairs. If it’s something you can plan for or delay, it’s not an emergency. Having clear criteria helps you protect your emergency fund for when it’s truly needed.

Financial stress often comes from uncertainty. Creating a plan that includes budgeting, saving and setting goals can reduce anxiety. Talk openly about money and make space for emotions. Consider journaling, counseling or financial coaching. You are not alone, and small steps can lead to big relief.

Strengthen Your Family Finances — Then Keep Growing

*The information provided on this website and within Westerra Credit Union’s financial education resources is for educational and informational purposes only. It is not intended to provide, and should not be construed as, financial, investment, tax, legal, or healthcare advice.Westerra Credit Union does not offer or provide guidance on individual tax situations, legal matters, or healthcare decisions. You should consult with a qualified financial advisor, tax professional, attorney, or healthcare professional for advice specific to your personal circumstances.While we strive to ensure the accuracy and timeliness of the information presented, Westerra Credit Union makes no guarantees or warranties, express or implied, regarding the completeness, reliability, or suitability of any information, products, or services referenced herein.Your use of this website and participation in any financial education materials or programs signifies your acknowledgment and agreement that Westerra Credit Union is not liable for any losses or damages that may arise from reliance on the information provided.