The Currency of Connection

When you stop to think about it, our entire lives revolve around relationships. From the very beginning, our relationship with our families, caregivers and teachers sets the foundation on which we build.

Read Article

Skip to Main Content

Why us? Westerra's community is built on meaningful personal relationships, not just transactions (though those are easy and convenient, too!). We're here for you with real support for your goals, your money and your financial education. And others are taking notice! In 2024, we were selected for Newsweek’s “America’s Best Regional Banks and Credit Unions” – one of only five Colorado-based financial institutions (and only one of 3 credit unions) selected for this prestigious list. That's the Westerra way.

In seven years with Westerra, Cynnomon Gordon has grown as a person and a professional. Find out how she balances being our Director of the Fraud Department and Card Dispute Operations, and a part-time pool shark, in her "Swim or Swim" video. Congrats to our creative team for their work on this video, which received the 2024 “Diamond Award” in the America’s Credit Unions’ prestigious credit union marketing competition. It also earned the Category’s Best award in the “Video Non-Commercial – Single” category, meaning the video achieved the highest score within the credit union’s asset level grouping. Here at Westerra, we are proud to work with the best to give our best to our members!

When you join Westerra, you're not just getting financial services — but an entire local community that comes with it. Together, we're all invested in one another's success, because when one wins, we all win. That's how it should be.

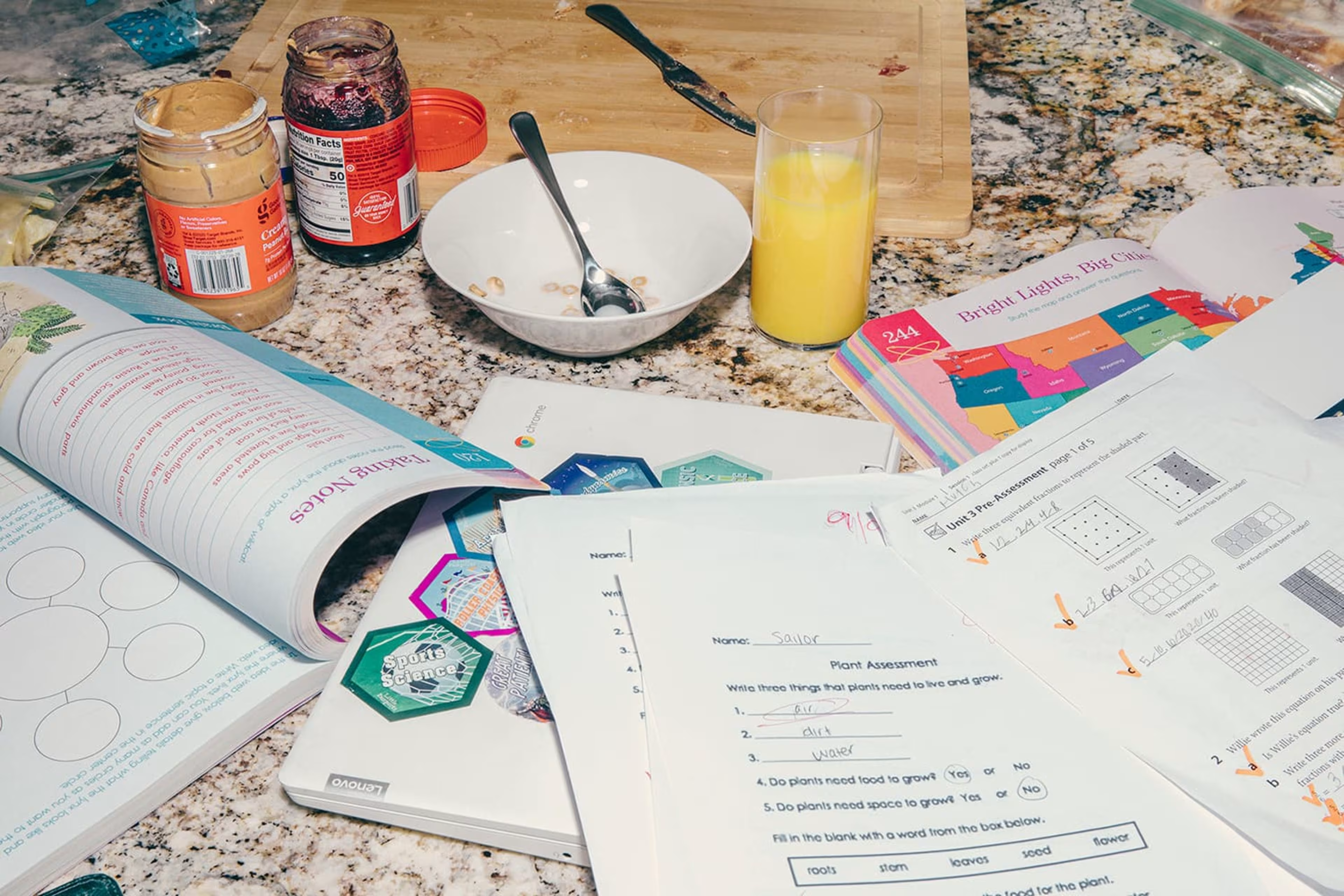

Westerra was founded by eight school teachers in 1934. Since then, we've continued our commitment to teaching one another to prosper. Today Westerra is a modern financial community with a deep local heritage.

If you're a people-first kinda person, you'll fit right in here. Check out our opportunities for rewarding and impactful careers with Westerra.

While much has changed in the financial services industry, in the world and at Westerra since we were formed 90-years ago, our purpose remains aligned with the original vision of those pioneering teachers.

When you stop to think about it, our entire lives revolve around relationships. From the very beginning, our relationship with our families, caregivers and teachers sets the foundation on which we build.

Read Article

On October 1st, 2025, a federal government shutdown was announced. Westerra Credit Union is showing up for it's members with the new Westerra Cares: Government Relief Loan.

Read Article

In many parts of the country, access to traditional banking has quietly faded away. What used to be a quick stop at a neighborhood branch has turned into a long drive or a complicated search for basic financial services.

Read Article