Westerra Cares

At Westerra Credit Union, we believe in the power of community and the importance of giving back. For 90 years and counting, we’ve lived and worked alongside you, dedicated to creating a brighter future. Discover more about our legacy and initiatives in our latest Annual Report.

Invested in our Community

Contributed over

$500,000

annually to our community

Volunteered

1500+

hours from our employees annually.

Awarded over

$50,000

annual grants for Colorado Educators

Financial Literacy Program

Westerra’s Financial Literacy Program (WFL) provides our members and community the tools and knowledge to thrive financially while navigating our changing, often confusing, financial times. By making financial literacy a cornerstone of our mission, Westerra is helping to create a stronger, more financially secure community. Because we believe nothing offers better returns than compound intelligence.

2024 School Grant Program

Westerra Credit Union funds $50,000 annually to our educators in Colorado school districts through our School Grant Program. We welcome Westerra members who are educators serving Early Childhood Education through Grade 12th in any Colorado school district to apply. The application period for School Year 2024-25 is now closed.

Westerra Credit Union Scholarship Program

Westerra Credit Union’s scholarship supports graduating high school seniors who are continuing their educational journey through two- or four-year universities or trade schools. Scholarships are provided by trusted community partners.

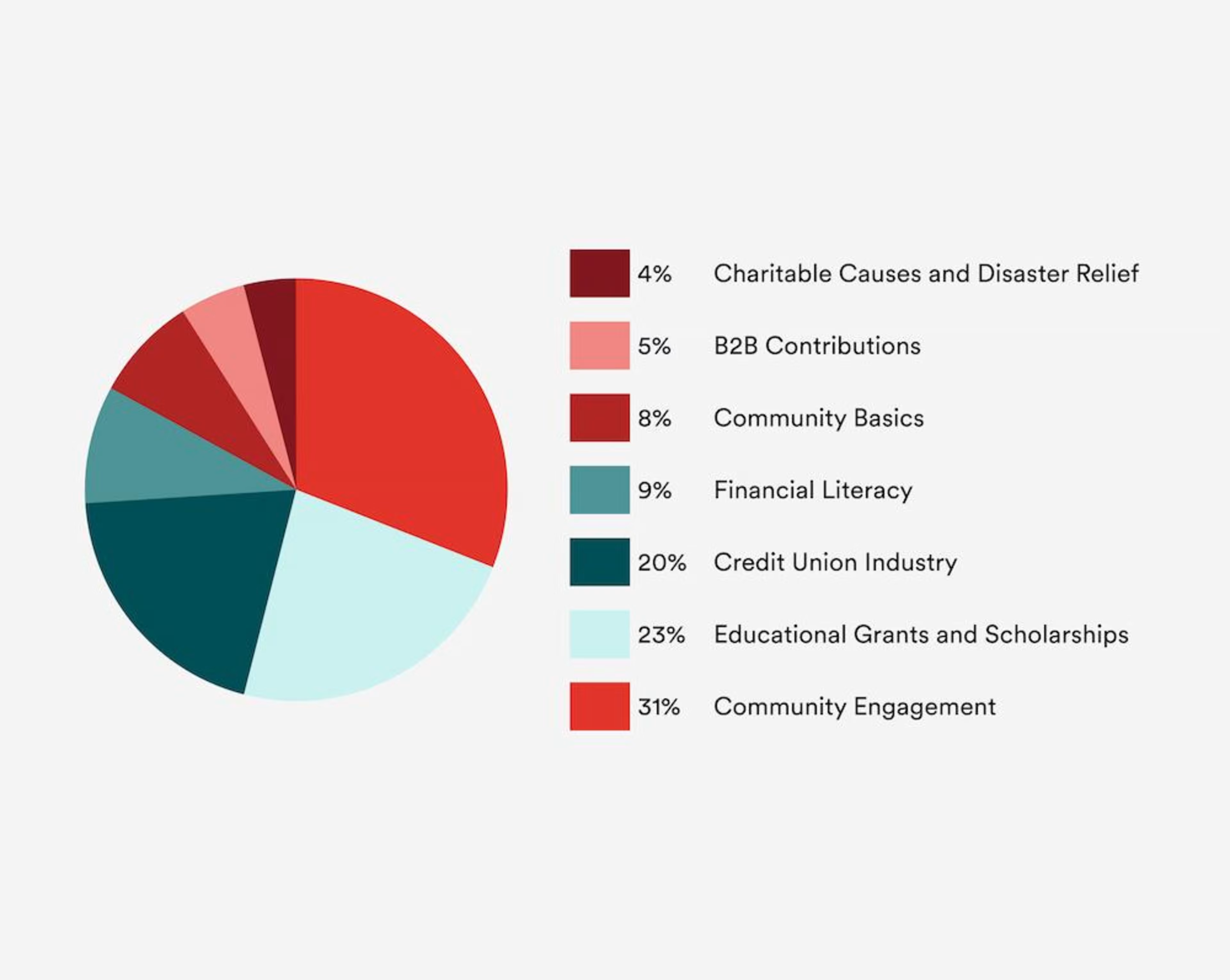

Get to Know Westerra Cares

In 2023, staff participation in Westerra Cares programs increased by 72%! The top areas staff supported were community engagement (31%) and educational grants and scholarships (23%). Westerra Credit Union was also honored with the prestigious Dora Maxwell Social Responsibility Award by the Go West Credit Union Association in recognition of their Westerra Cares community engagement initiative and Andrea McDermott, Westerra’s Community Engagement Manager, received the Credit Union Times’ Luminaries Award Community Impact [Individual].