Business

You're the boss

And when you're the boss, you should feel empowered to make the best financial decisions for your business, with the best tools. We've got all that, plus a built-in network of support. Partner with Westerra, and become the savviest biz on the block.

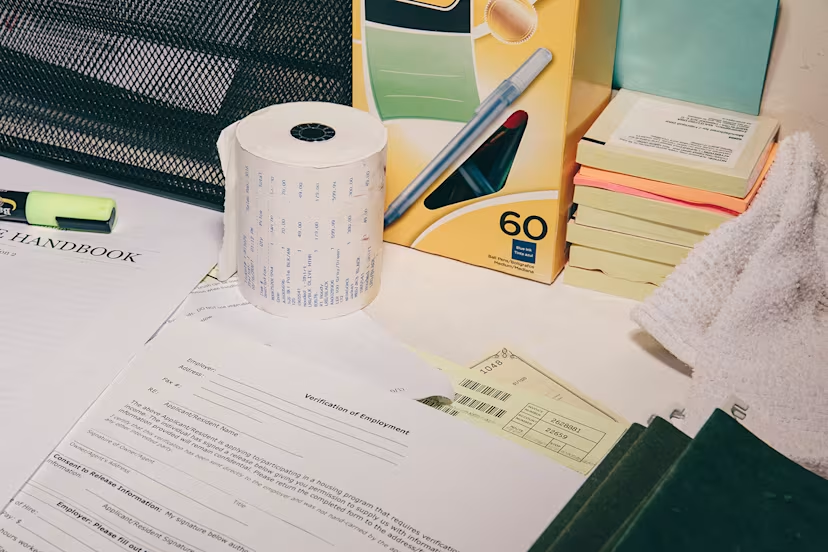

Local checking for local business

Get a business checking account with Westerra. With local branches, we'll be here for you whenever needs arise.

Business credit cards

Running your own business comes with its own rewards, but you'll get even more by using one of our premiere business reward credit cards. Easily separate your personal and business expenses, track your spending, and reap the rewards.

The Westerra humble-brag

→ Why us? Westerra's community is built on meaningful personal relationships, not transactions. We're here for you with real support for your goals, your money and your financial education. That's the Westerra way.

There’s a lot to love about business checking with Westerra

See how your business can save

Looking for more business services?